This guide explains 2026 Medicare Open Enrollment and other Medicare enrollment periods. Don't miss this important time to review and change your Medicare coverage.

Read moreSpeak with a licensed insurance agent

Speak with a licensed insurance agent

Find a $0 premium Medicare Advantage plan today.

Medicare uses a five-star rating system to evaluate Medicare Advantage plans. Medicare star ratings can change from one year to the next. Learn how to compare star ratings for the Medicare Advantage plans offered in your area.

All Medicare Advantage plans (Medicare Part C) and Medicare prescription drug plans (Medicare Part D) are assigned an annual star rating by the Centers for Medicare & Medicaid Services (CMS).

A five-star rating system is used, with one star being given to the lowest-rated plans, and five stars being reserved for only the highest-rated plans. Star Ratings are calculated each year and may change from one year to the next.

Five-star Medicare Advantage plans may not be available where you live. You can use the Medicare star ratings to help you compare the plans that are available in your area.

In 2026, roughly 62 percent of beneficiaries in Medicare Advantage plans that offer prescription drug coverage are enrolled in a plan rated 4 stars or higher by Medicare, when weighted by enrollment.1

We offer plans from Humana, UnitedHealthcare®, Anthem Blue Cross and Blue Shield*, Aetna, HealthSpringSM, Wellcare, or Kaiser Permanente.

Enrollment may be limited to certain times of the year. See why you may be able to enroll today.

Medicare determines which Medicare Advantage plans are highest rated based on information gathered from health care providers who accept the plan, plan member satisfaction surveys, positive health outcomes, customer service and more.

A 5-star plan is considered a highest-rated plan. 1-star plans are the lowest-rated plans, and these plans typically earn their low rating due to poor plan performance, low customer satisfaction and/or bad customer service.

The star rating system for Medicare Advantage plans is as follows:

|

Star Ratings |

|

|---|---|

|

★★★★★ |

Excellent |

|

★★★★ |

Above Average |

|

★★★ |

Average |

|

★★ |

Below Average |

|

★ |

Poor |

The rating system uses five key metrics in its assessment of a Medicare Advantage plan:

In addition to an overall rating, each Medicare Advantage plan is rated in each of the five individual categories. Medicare Star Ratings are released in October of each year for the upcoming calendar year.

If a plan receives a rating of fewer than three stars for three consecutive years, it becomes flagged by the CMS as a low-performing plan. If the plan continues to underperform, Medicare may remove the plan entirely from the marketplace.

Because the availability of Medicare Advantage plans varies from one location to the next, you may want to call to speak with a licensed insurance agent. A licensed sales agent can go over the plan options available in your area and identify if any have a five-star rating.

An agent can also discuss the costs, terms, coverage and other details about available plans, which can be helpful for you to know prior to enrolling. And if you choose to enroll, you’re eligible to enroll and you have a qualifying enrollment period, the agent can walk you through the steps and help you complete the process.

|

|

There are certain Medicare enrollment periods during which eligible Medicare beneficiaries may enroll in a Medicare Advantage plan.

You can sign up for a five-star plan (if you’re eligible, have a qualifying enrollment period and find a five-star plan in your area) when you first become eligible for Medicare Advantage. Your eligibility begins once you are enrolled in both Medicare Part A and Part B.

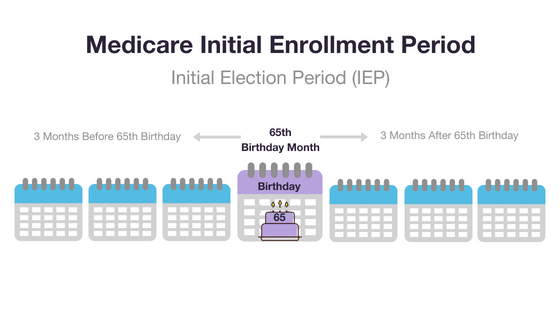

When you reach Medicare eligibility, you are typically given a 7-month Medicare Initial Enrollment Period. This period begins three months before you turn 65 years old, includes the month of your birthday and continues for three months thereafter.

If you are already enrolled in Part A and/or Part B, you may sign up for a Medicare Advantage plan during the fall Medicare Open Enrollment Period (also sometimes called the Medicare Advantage Annual Enrollment Period), which lasts from October 15 to December 7 each year.

If you are already enrolled in a Medicare Advantage plan, you may use this time to switch to a different Medicare Advantage plan or drop your plan to remain on Original Medicare.

If you are currently enrolled in a plan that is rated as fewer than five stars, you may be able to utilize the Medicare Five-Star Special Election Period to disenroll from your current plan and enroll in a five-star Medicare Advantage plan if one is available where you live.

As mentioned above, this period lasts from December 8 to November 30 of the following year. During this period, you can only switch to a five-star plan.

Being enrolled in a Medicare Advantage plan with fewer than five stars isn’t the only way to qualify for a Medicare Special Enrollment Period.

Special Enrollment Periods may be granted to individuals for a variety of circumstances, such as but not limited to living outside of the U.S. at the time of your initial Medicare eligibility or residing in a long-term care facility.

Call to speak with a licensed insurance agent today to learn more about the Medicare Advantage plan options near you.

As mentioned above, roughly 62 percent of Medicare Advantage beneficiaries in plans that include prescription drug coverage (called MA-PD plans) are enrolled in 2026 Medicare Advantage plans rated 4 stars or higher.

Approximately 40 percent of all MA-PD plans offered in 2026 are top-rated plans four stars or higher.1

The table below shows the distribution of MA-PD plans based on their Star Ratings.1

| Overall Star Rating | Number of Plan Contracts | % of Total Plans (Weighted by Enrollment) |

|---|---|---|

| 5 Stars | 7 | 1.79% |

| 4.5 Stars | 86 | 28.87% |

| 4 Stars | 116 | 31.47% |

| 3.5 Stars | 165 | 27.71% |

| 3 Stars | 123 | 9.16% |

| 2.5 Stars | 23 | 1% |

| 2 Stars | 1 | 0.01% |

| Average Star Rating (weighted by enrollment) | 3.92 | |

The Centers for Medicare & Medicaid Services started using the star rating system in 2007 to evaluate Medicare Advantage plan contracts. The goal of the Medicare star rating system is to help Medicare-eligible individuals and Medicare beneficiaries better understand the quality of the plans that are available on the market.

Learn more about the Medicare Advantage plans available where you live and their star ratings.

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

..Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles he’s written, helping Americans better understand their health insurance and Medicare coverage.

Christian’s work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. His articles are read by thousands of older Americans each month. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care.

Christian’s passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

A current resident of Raleigh, Christian is a graduate of Shippensburg University with a bachelor’s degree in journalism.

If you’re a member of the media looking to connect with Christian, please don’t hesitate to email our public relations team at Mike@tzhealthmedia.com.