For most people, Medicare renews automatically every year — you usually don’t have to do anything to keep your coverage active. Original Medicare (Parts A and B) continues as long as you pay your Part B premium, and most Medicare Advantage (Part C) and Part D prescription drug plans automatically renew if they’re still offered in your area.

However, because plans and costs can change annually, it’s a good idea to review your Annual Notice of Change (ANOC) each fall to make sure your current plan still fits your needs.

There may be some situations, however, in which your Medicare coverage will not renew.

You may also want to review your Medicare coverage each Fall to take advantage of other Medicare plan options that could potentially offer you more coverage and save you money.

Compare plans today.

Speak with a licensed insurance agent

Will my Medicare Part A and/or Part B plan automatically renew?

If you’re enrolled in Original Medicare (Parts A and B), you typically don’t need to do anything for your coverage to continue.

- Part A (Hospital Insurance) – This covers inpatient hospital care, skilled nursing, and some home health services. If you qualify based on your work history, it renews automatically each year.

- Part B (Medical Insurance) – This covers doctor visits, outpatient care, and preventive services. As long as you keep paying your monthly Part B premium, your coverage will stay active.

You may only need to take action if you:

- Decide to drop Part B (for example, if you get employer coverage).

- Miss a premium payment.

- Move permanently out of the U.S.

Will my Medicare Advantage plan auto-renew?

If you have a Medicare Advantage plan, your coverage also usually renews automatically each year as long as the plan remains available in your area and you continue paying any plan premiums.

However, your plan’s benefits, provider network, and costs can change every year. That’s why Medicare sends you an Annual Notice of Change (ANOC) each fall. Review it carefully — it outlines what’s changing for the next calendar year.

If you’re satisfied with your current plan, you don’t need to do anything and it will renew.

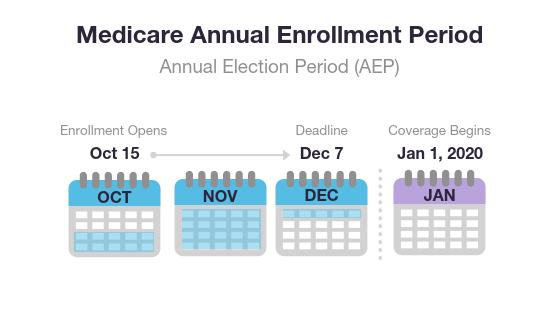

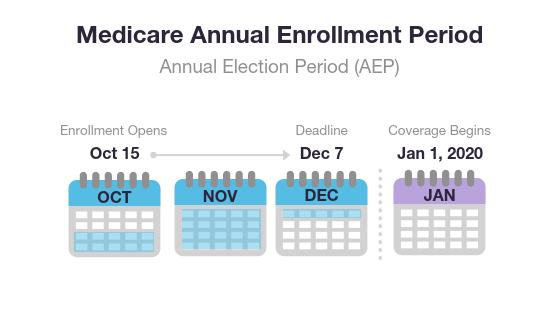

If you’d like to change plans, you can do so during the Medicare Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year.

Will My Part D Prescription Drug Plan Renew Automatically?

Like Medicare Advantage, Part D prescription drug plans generally renew automatically as long as the plan continues to be offered.

Each year, though, it’s smart to:

- Check your medication list: Make sure your prescriptions are still covered and that your pharmacy is in-network.

- Compare costs: Drug tiers and copays can change.

- Review your ANOC: You’ll receive this notice each September detailing changes for the following year.

If your plan is leaving your area, Medicare will send you a notice so you can choose a new one before the next coverage year begins.

When will my Medicare plan not automatically renew?

Situations in which these types of Medicare plans might no longer be provided can include:

- The plan is deemed to be low performing

Medicare rates all Medicare Advantage plans and Part D plans each year using the Medicare Star Rating system. Each plan is given a rating of one to five stars, with five stars being the highest ranking.1

If a plan receives fewer than three stars for three consecutive years, Medicare will flag the plan as low performing. Medicare reserves the right to discontinue low-performing plans from being offered.

If this happens, all members of the plan will receive a notice informing them of the decision, and they will be granted a Special Enrollment Period to sign up for a different Medicare plan.

- The plan stops serving your area

A Medicare Advantage plan, a Part D plan or a Medicare Supplement Insurance plan may occasionally change its coverage area and stop providing benefits to a particular location.

If this happens, plan members may be given a Special Enrollment Period to sign up for a different Medicare plan that is offered in their area for the coming year.

- The insurance company stops providing the plan

Medicare Advantage plans, Medicare Part D plans and Medicare Supplement Insurance plans are sold by private insurance companies. The company that provides a plan may choose to no longer offer that specific plan.

If this happens, plan members may be granted a Special Enrollment Period to enroll in a new Medicare plan.

Review your Plan Annual Notice of Change (ANOC)

If you’re enrolled in a Medicare Advantage plan or a Medicare Part D plan, you will receive a “Plan Annual Notice of Change” in the mail each September.

This notice will call attention to any changes in plan costs, benefits or service area adjustments for the upcoming year.

If there are any changes made to your plan that affect your overall satisfaction with the coverage, you may have a few opportunities to make any desired changes.

When can you make changes to your Medicare coverage?

There are a few times throughout the year that you may be able to make changes to your Medicare coverage, including Medicare Advantage and Medicare Part D prescription drug plans.

The Annual Enrollment Period (AEP)

The Medicare Annual Enrollment Period (also known as the Fall Medicare Open Enrollment Period for Medicare Advantage plans) takes place each year from October 15 to December 7.

During this time, you may join, leave or switch Medicare Advantage plans or Medicare Part D plans.

The Five-Star Medicare Enrollment Period

Anyone who is enrolled in a Medicare Advantage or Medicare Part D plan with a rating of fewer than five stars is typically eligible to make changes to their Medicare coverage during the Five-Star Special Enrollment Period.1

From December 8 to November 30 of the following year, you may change your Medicare coverage in the following ways:

- Switch from Original Medicare to a five-star Medicare Advantage plan

- Switch from a Medicare Advantage plan with fewer than five stars to a five-star plan

- Switch from a Part D plan with fewer than five stars to a five-star plan

- Switch from one five-star Medicare Advantage plan to another five-star Medicare Advantage plan

- Switch from a Medicare Advantage or Part D plan to a five-star Medicare Cost Plan

Medicare Special Enrollment Period (SEP)

Some Medicare beneficiaries may qualify for a Special Enrollment Period (SEP) at any time throughout the year to beneficiaries who experience a qualifying event.

These can include (but are not limited to):

- Moving out of your plan’s service area or moving to an area with additional coverage options

- Moving back to the U.S. after living outside of the country

- Residing in, moving into or moving out of a skilled nursing facility or long-term care hospital

- Being released from jail

- Losing Medicaid eligibility

- Losing or leaving employer, union or COBRA coverage

- Losing drug coverage that’s at least as good as Medicare drug coverage

- Medicare terminates its contract with your plan or takes a sanction against it

There are other reasons a beneficiary may qualify for a Medicare SEP. A licensed insurance agent can help you determine your eligibility.

Medicare General Enrollment Period (GEP)

The Medicare General Enrollment Period (GEP) lasts from January 1 to March 31 each year.

Beneficiaries who did not sign up for Medicare Part A or Part B during their Initial Enrollment Period may do so during the General Enrollment Period. However, you may be subject to late enrollment fees for doing so.

Will my Medicare Supplement (Medigap) plan auto-renew?

You may drop a Medicare Supplement Insurance plan at any time. However, you may have trouble being accepted into a new Medigap plan, and you will likely be subject to medical underwriting if you do so.

In many cases, you may be able to take advantage of a 30-day “free look” period:

- For 30 days, you can carry two Medigap plans: your current plan and the plan you are considering changing to.

- At the end of the 30 day period, you will decide which plan to keep and which one to drop.

- You will need to pay the plan premiums for both plans while you are enrolled in each plan.

Review your Medicare options each year

There are limited times throughout the year that you may drop, switch or add Medicare coverage, so it’s important to take advantage of those opportunities to review your coverage options instead of depending on automatic Medicare renewal.

Each fall, it’s wise to review your Medicare coverage and consider all of the following:

- Have any of your plan costs gone up?

- Have your plan benefits changed?

- Has the network of participating doctors changed? And more specifically, is your favorite doctor still part of your plan network?

- Have you experienced any changes in your health that require a different set of health insurance coverage?

- Will you be traveling outside the U.S. in the upcoming year?

- Will you be moving to a new address?

Get help with Medicare renewal and review plan options in your area

Fortunately, there’s an easy way to conduct your annual Medicare review. You can speak to a licensed insurance agent, who can help you review your Medicare benefits and any upcoming plan changes.

They can also help you compare other plan options available in your area and find plans that could potentially help you save money.

Or call 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!